In the fast-paced world of cryptocurrency mining, where fortunes can pivot on the edge of a silicon chip, monitoring your mining machines emerges as the unsung hero of investment protection. Imagine a fleet of powerful rigs humming away in a distant data center, churning out Bitcoin or Ethereum blocks with relentless precision. Without vigilant oversight, these machines could falter, leading to lost revenue, hardware failures, and ultimately, a dent in your financial portfolio. This article delves into the intricacies of mining machine monitoring, exploring how it safeguards your assets in an industry as volatile as the digital currencies it supports.

At its core, a mining machine—often referred to as a miner or mining rig—is a specialized computer designed to solve complex cryptographic puzzles for networks like BTC (Bitcoin) or ETH (Ethereum). These devices are the workhorses of blockchain technology, validating transactions and securing decentralized ledgers. But what happens when a rig overheats, a component wears out, or network connectivity falters? Enter monitoring systems, which act as the watchful guardians, providing real-time data on performance metrics such as hash rates, temperature, and energy consumption. By leveraging advanced software, users can detect anomalies early, preventing catastrophic downtime that could erode profits in a market where every second counts.

Picture this: a bustling mining farm, filled with rows of miners operating around the clock, their fans whirring like a symphony of industry. In such environments, monitoring isn’t just a luxury; it’s a necessity. For instance, if a Dogecoin (DOG) mining rig suddenly drops in efficiency, it might signal an impending hardware failure. Tools like remote monitoring dashboards allow operators to track multiple machines from anywhere in the world, offering alerts via email or mobile notifications. This level of oversight ensures that your investment in high-end hardware doesn’t go to waste, transforming potential losses into sustained gains.

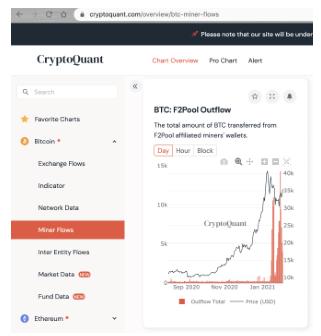

Now, let’s consider the broader implications for different cryptocurrencies. When monitoring BTC-related miners, for example, users often focus on optimizing for the Proof-of-Work algorithm, which demands immense computational power.

This is where bursty monitoring strategies shine—alternating between quick checks for immediate issues and in-depth analyses for long-term trends. Similarly, ETH miners, especially those transitioning to Proof-of-Stake, require adaptive monitoring to handle software updates and network shifts, ensuring your setup remains competitive amid evolving protocols.

The diversity of threats in mining operations demands a multifaceted approach. From power surges that could fry a mining rig’s circuits to malware attacks targeting vulnerable software, the risks are as varied as the cryptocurrencies themselves. Effective monitoring systems employ AI-driven analytics to predict failures before they occur, much like a seasoned captain navigating stormy seas. This predictive capability adds layers of protection, allowing you to allocate resources wisely and avoid the unpredictable costs of reactive repairs.

Moreover, for those engaging in mining machine hosting, where third-party facilities manage your rigs, monitoring becomes a shared responsibility. Hosts often provide their own oversight tools, but savvy investors integrate personal systems for an extra layer of security. This hybrid model not only enhances transparency but also fosters a rhythmic balance between trust and vigilance, ensuring that your investment in DOG, ETH, or any other coin yields optimal returns.

Burstiness in monitoring practices—fluctuating between rapid, on-the-spot interventions and comprehensive reviews—mirrors the dynamic nature of the crypto market. A short, sharp alert for a overheating miner can be followed by a detailed diagnostic report, creating a narrative of proactive defense. In contrast, routine checks might reveal subtle patterns, like gradual declines in hash rates for a BTC rig, prompting timely upgrades that preserve your edge.

Ultimately, the value of mining machine monitoring extends beyond mere protection; it cultivates a deeper, more intimate understanding of your operations. By analyzing data from various mining farms and rigs, you gain insights into efficiency improvements, cost reductions, and even market trends. Whether you’re a solo miner tinkering with a single setup or managing a vast array, this vigilance transforms your investment from a static asset into a thriving, adaptive entity.

In a world where cryptocurrencies like Bitcoin continue to captivate global attention, safeguarding your mining endeavors isn’t just smart—it’s essential for long-term success.

Leave a Reply to DawnZ Cancel reply