The digital gold rush is on, and for those seeking to strike it rich, understanding the landscape of cryptocurrency mining is paramount. Canada, with its stable energy infrastructure and cooler climate, has emerged as a compelling hub for mining operations. This article delves into the essential elements of crypto mining, with a specific focus on ASIC rigs and the lucrative opportunities presented by wholesale deals within the Canadian market.

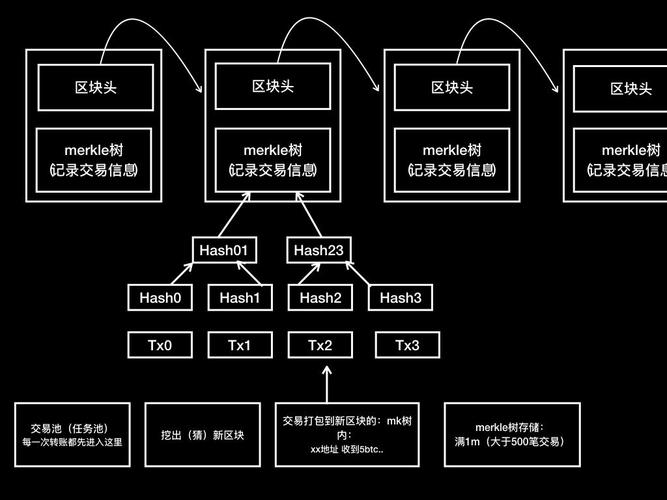

Cryptocurrency mining, at its core, is the process of verifying and adding new transaction records to a blockchain – the decentralized, public ledger that underpins cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and even meme coins like Dogecoin (DOGE). Miners deploy powerful computers to solve complex cryptographic puzzles. The first to solve the puzzle gets to add the next block of transactions to the blockchain and is rewarded with newly minted cryptocurrency.

The hardware of choice for serious miners are Application-Specific Integrated Circuits, or ASICs. Unlike GPUs (Graphics Processing Units), which can be used for a variety of tasks including gaming and video editing, ASICs are designed specifically for one purpose: mining. This specialization translates to significantly higher hash rates and energy efficiency when tackling the algorithms that secure blockchains like Bitcoin. Investing in the right ASIC rig is the foundation of a profitable mining venture.

Navigating the Canadian wholesale market for ASIC rigs requires strategic thinking. Sourcing directly from manufacturers or large distributors often unlocks substantial cost savings. Factors to consider when evaluating wholesale deals include the ASIC model’s hash rate, power consumption, price per terahash, warranty terms, and the supplier’s reputation. Due diligence is critical to avoid counterfeit or faulty equipment.

Bitcoin, the king of cryptocurrencies, remains a primary target for ASIC miners. Bitcoin mining relies on the SHA-256 algorithm, and specialized ASICs are the only economically viable option for competing on the network. Newer generation ASICs from manufacturers like Bitmain (Antminer series) and MicroBT (WhatsMiner series) offer superior performance, but come with a higher price tag. Older models may be more affordable but may struggle to compete in the long run due to increasing difficulty and energy costs.

While Bitcoin dominates the ASIC landscape, other cryptocurrencies can also be mined using specialized hardware. However, it’s crucial to understand the underlying algorithm. Ethereum’s transition to Proof-of-Stake (PoS) largely eliminated the need for ASIC mining on its network, shifting the focus to staking. However, Ethereum Classic (ETC), a fork of the original Ethereum blockchain, continues to be mineable, albeit with lower profitability compared to Bitcoin. Exploring alternative ASIC-minable coins requires careful analysis of their profitability, network hashrate, and future potential.

Beyond the rigs themselves, a crucial component of crypto mining is infrastructure. Canada’s cool climate provides a natural advantage in managing the heat generated by ASIC miners. Hosting facilities, often referred to as mining farms, provide the necessary power, cooling, and security infrastructure to house large-scale mining operations. These facilities charge fees based on power consumption and other services. Evaluating hosting options in Canada involves considering factors such as electricity rates, uptime guarantees, security measures, and proximity to reliable internet connectivity.

Doge coin on the other hand, has a different algorithm called Scrypt. ASICs for Scrypt exist, but their economics and profitability have been volatile, often overshadowed by the potential of mining Bitcoin or other SHA-256 based coins. The meme-driven nature of Dogecoin adds another layer of complexity, as its value and mining profitability are susceptible to sudden shifts in sentiment and market trends. Careful research and risk assessment are vital before investing in Dogecoin mining ASICs.

Investing in crypto mining is not without risks. Cryptocurrency prices are notoriously volatile, which directly impacts mining profitability. Increasing network difficulty requires miners to upgrade their equipment regularly to remain competitive. Regulatory changes can also impact the viability of mining operations in certain jurisdictions. Thorough due diligence, a long-term perspective, and a robust risk management strategy are essential for success in the dynamic world of crypto mining.

Leave a Reply